Introduction

With the explosive growth of artificial intelligence (AI) technology, the AI server heatsink market is undergoing unprecedented expansion. The widespread deployment of high-performance GPUs and dedicated AI accelerators has introduced significant thermal management challenges, driving rapid innovation in cooling technologies and reshaping the market landscape. This article provides an in-depth analysis of current trends, technological innovations, and investment opportunities in the AI server heatsink market, offering comprehensive insights for relevant enterprises and investors.

1. Explosive Growth Driven by AI in the Heatsink Market

The rapid development of artificial intelligence is revolutionizing the computing hardware market, particularly creating unprecedented demand growth in the field of cooling solutions.

Problem: The traditional growth model of the cooling market has been completely disrupted by the AI revolution.

Imagine this scenario: before the AI wave, the server heatsink market developed at a relatively stable compound annual growth rate (CAGR) of 5-7%, primarily driven by data center expansion and processor performance improvements. Now, we are witnessing a true market revolution.

Here’s the key point: the massive demand for computing resources in AI training and inference is driving large-scale deployment of high-performance GPUs and dedicated AI accelerators. These devices have thermal design power (TDP) far exceeding traditional server components, creating an explosive demand for advanced cooling solutions.

Aggravation: Market research shows that this growth rate far exceeds industry expectations, creating a supply-demand imbalance.

According to the latest market reports, the AI server heatsink market is expected to achieve a CAGR of 23.5% during the 2023-2028 period, growing from approximately $4.7 billion in 2022 to over $16.5 billion in 2028. This growth rate is 3-4 times that of the traditional data center cooling market.

Notably, high-end liquid cooling solutions are experiencing even more rapid growth, with an expected CAGR of 35-40%. This indicates that the market is rapidly shifting towards more advanced cooling technologies to address the extreme thermal challenges posed by AI hardware.

Solution: Understanding this market dynamic is crucial for corporate strategic planning and investment decisions.

| Drivers of AI Server Heatsink Market Growth |

|---|

| Driver |

| Expansion of AI Training Clusters |

| Increase in Edge AI Deployments |

| GPU Performance Improvements |

| Increase in Data Center Density |

| Stricter Energy Efficiency Regulations |

Market Size and Growth Forecast

The growth of the AI server heatsink market is reflected not only in the overall scale but also in the rapid development of various sub-segments:

- By Cooling Technology:

- Liquid Cooling Solutions: Accounted for approximately 35% of the market in 2022, expected to grow to 55-60% by 2028.

- Air Cooling Solutions: While market share is declining, absolute scale continues to grow.

- Hybrid Cooling Systems: As transitional technologies, significant growth is expected in the next 3-5 years.

- By Application Scenario:

- Hyperscale Data Centers: Occupy the largest market share, about 45-50%.

- Enterprise Data Centers: Approximately 25-30% market share, with stable growth.

- Edge Computing Facilities: The fastest-growing sub-segment, with an expected CAGR of 30%.

- High-Performance Computing (HPC) Clusters: Market share around 15%, but with the highest technical requirements.

- By Component Type:

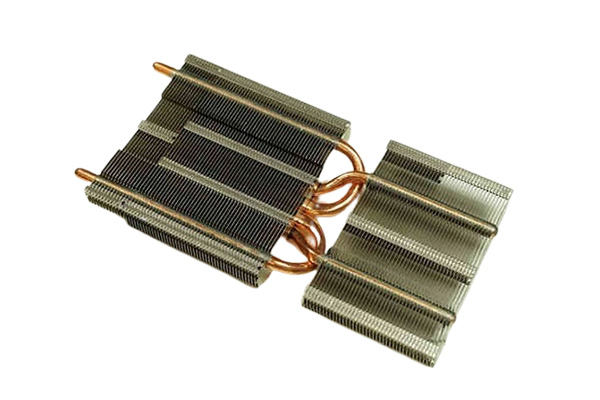

- Heatsinks/Cold Plates: The largest component sub-market.

- Coolant Distribution Units (CDU): The fastest-growing component category.

- Heat Exchangers: Market size growing steadily.

- Control Systems: Rapid development with increasing demand for intelligent cooling.

An interesting phenomenon here is that although liquid cooling technology is growing rapidly, the market has not seen complete dominance by a single technology. Instead, we observe the parallel development of multiple cooling technologies to meet the needs of different application scenarios. This diversification trend creates a variety of market opportunities for enterprises of different scales and specialties.

2. Innovations in Cooling Technologies and Market Competition Landscape

The rapid growth of the AI server heatsink market is accompanied by accelerated technological innovation and a reshaping of the competitive landscape. Understanding these dynamics is crucial for identifying market opportunities and potential risks.

Problem: Traditional cooling technology suppliers face dual challenges from innovative startups and cross-industry giants.

In this rapidly evolving market, relying solely on past technologies and business models is no longer sufficient to maintain competitiveness. Traditional cooling solution providers must innovate quickly or risk being disrupted by emerging technologies and business models.

Aggravation: The cycle of technological innovation is accelerating, making product differentiation and intellectual property protection increasingly important.

More concerning is the clear trend of market consolidation, with large technology companies and data center operators entering the cooling technology field through acquisitions or in-house development. This could further squeeze the survival space of small and medium-sized suppliers.

Solution: Understand the market competition landscape and technological innovation trends, and formulate clear differentiation strategies:

Hotspots in Technological Innovation

Innovations in cooling technology are advancing simultaneously in multiple directions:

- Breakthroughs in Material Science:

- Graphene Composites: Thermal conductivity 5-10 times higher than traditional copper heatsinks.

- Phase Change Materials (PCM): Capable of absorbing thermal peaks, providing more stable temperature control.

- Carbon Nanotube Interface Materials: Reduce thermal interface resistance, improving overall cooling efficiency.

- Innovations in Liquid Cooling Technology:

- Microchannel Cold Plates: Increase contact area, enhancing thermal conduction efficiency.

- Jet Impingement Cooling: Directly sprays coolant onto hotspot areas.

- Two-Phase Immersion Cooling: Utilizes coolant phase change to provide extremely high cooling efficiency.

- System Integration and Intelligent Control:

- AI-Driven Predictive Cooling: Uses machine learning to optimize cooling parameters.

- Digital Twin Technology: Creates detailed thermal models to optimize cooling strategies in real-time.

- Modular Cooling Architecture: Provides flexible expansion paths and simplified maintenance.

Here’s where it gets interesting: these innovations are not merely incremental improvements but potentially disruptive technologies that could reshape the market landscape. For example, some new liquid cooling technologies can improve cooling efficiency by 50–70% while reducing energy consumption by 30–40%. That level of improvement could redefine the competitive basis of the entire industry.

Market Competition Landscape

The competitive landscape of the AI server heatsink market is undergoing significant transformation:

- Traditional Cooling Solution Providers:

- Strengths: Rich industry experience, broad customer base, mature manufacturing capabilities

- Challenges: Must rapidly adapt to new technologies to avoid disruption

- Representative Companies: Vertiv, Schneider Electric, Asetek, CoolIT Systems

- Technology-Driven Startups:

- Strengths: Focus on disruptive technologies, agile business models, fast innovation

- Challenges: Scaling production, building market trust, securing funding

- Representative Companies: Submer, GRC (Green Revolution Cooling), Iceotope, ZutaCore

- System Integrators and OEMs:

- Strengths: End-to-end solution capability, strong distribution networks, brand recognition

- Challenges: Need to integrate diverse technologies while balancing cost and performance

- Representative Companies: Dell Technologies, HPE, Lenovo, Super Micro Computer

- Hyperscale Cloud Providers:

- Strengths: Massive purchasing power, internal R\&D capabilities, vertical integration potential

- Challenges: Require standardized solutions and must balance in-house development with procurement

- Representative Companies: Google, Microsoft, Amazon, Meta

AI Server Heatsink Market Competitive Landscape

| Company Type | Market Share Trend | Tech Strength | Business Model Innovation | Growth Potential |

| Traditional Vendors | Stable/Slight Decline | Medium | Low | Medium |

| Tech Startups | Rapid Growth | High | High | High |

| Integrators/OEMs | Steady Growth | Medium-High | Medium | Medium-High |

| Hyperscale Providers | Indirect Influence Rising | High | Medium-High | Not Applicable* |

*Note: Hyperscale providers are primarily buyers and tech drivers, not direct competitors.

Patent and IP Landscape

In this innovation-driven market, intellectual property has become a key competitive advantage:

- Patent Application Trends:

- Liquid cooling technology patents have surged over 300% in the last 5 years

- Smart cooling control system patents are growing fastest

- Material science innovations account for about 25% of patent applications

- IP Strategy:

- Large companies adopt broad patent portfolios

- Startups focus on deep protection of core technologies

- Cross-industry collaborations and licensing models are increasing

- Regional Differences:

- U.S. companies lead in system design and control algorithms

- Asian firms excel in manufacturing processes and materials application

- European players are at the forefront of sustainability and energy-efficient technologies

Here’s the exciting part: patent analysis shows that liquid cooling tech is in a breakout innovation phase, with exponential growth in filings. This suggests the market is in the early acceleration stage of the technology S-curve, signaling more breakthroughs and opportunities in the years ahead.

Patent and IP Landscape

IP has become a key competitive advantage in this innovation-intensive market:

- Patent application trends:

- Patent applications for liquid cooling technology have grown by more than 300% in the past 5 years

- Patents related to intelligent cooling control systems have grown fastest

- Material science innovations account for about 25% of patent applications

- IP strategy:

- Large companies adopt a broad patent portfolio strategy

- Startups focus on deep patent protection of core technologies

- Cross-industry cooperation and technology licensing models increase

- Regional differences:

- US companies lead in system design and control algorithms

- Asian companies have obvious advantages in manufacturing processes and material applications

- European companies are at the forefront of sustainability and energy efficiency technologies

Are you ready for the exciting part? Patent analysis shows that liquid cooling technology is experiencing an explosion of innovation, with the number of patent applications growing exponentially. This indicates that the market is in the early acceleration stage of the technology S curve, indicating that more breakthrough innovations and market opportunities will emerge in the next few years.

3. Regional Market Analysis and Growth Forecast

The AI server radiator market is showing uneven growth around the world, and the market dynamics in each region are significantly affected by local data center development, AI adoption rates, and regulatory environments.

Problem: The global AI server radiator market shows complex regional differences, requiring targeted market strategies.

When formulating a global expansion strategy, simply copying the successful model of one region to another may lead to failure. Each regional market has its own unique needs, challenges, and growth drivers.

Aggravation: The technology adoption gap, regulatory requirements, and infrastructure maturity between regions further complicate the market landscape.

Even more challenging, energy costs, climate conditions, and sustainable development policies vary greatly from region to region, which directly affects the economic feasibility and market acceptance of specific cooling technologies.

Solution: Deeply understand the characteristics and growth drivers of each regional market and formulate differentiated regional strategies:

North American Market Analysis

North America is the world’s largest AI server heat sink market and a major center for technology innovation:

- Market Size and Growth:

- The market size in 2022 is about $1.8 billion, accounting for 38% of the global market

- The compound annual growth rate is expected to be 21% from 2023 to 2028

- Liquid cooling technology has the fastest growth, with an annual growth rate of more than 30%

- Market Drivers:

- Large-scale AI investment by hyperscale cloud service providers

- A strong AI startup ecosystem drives the demand for innovation

- High energy costs drive the adoption of efficient cooling solutions

- Regional Characteristics:

- A strong focus on innovation and performance optimization

- A strong focus on total cost of ownership (TCO)

- Increasing sustainability and energy efficiency requirements

A key trend in the North American market is that hyperscale data center operators (such as Google, Microsoft, and Meta) are shifting from traditional suppliers to more innovative cooling solutions, including customized liquid cooling systems and immersion cooling. This shift is reshaping the entire supply chain and technology roadmap.

European Market Analysis

The European market is known for its stringent energy efficiency standards and sustainability requirements:

- Market Size and Growth:

- The market size in 2022 is approximately $1.2 billion, accounting for 25% of the global market

- The CAGR is expected to be 24% from 2023 to 2028

- Sustainable cooling solutions have the fastest growth

- Market Drivers:

- Stringent energy efficiency and carbon emission regulations

- High energy costs drive the adoption of efficient cooling technologies

- Strong focus on heat recovery

- Regional Characteristics:

- Leading sustainable development and circular economy practices

- High acceptance of liquid cooling technology

- Emphasis on long-term operating costs rather than initial investment

A unique trend in Europe is the widespread adoption of heat recovery systems, which use waste heat from data centers for district heating or other purposes. This approach not only improves energy efficiency, but also creates additional economic value, making the business case for certain advanced cooling technologies more attractive.

Asia Pacific Market Analysis

The Asia Pacific region is the fastest growing AI server heat sink market, especially China, Japan, South Korea and Singapore:

- Market size and growth:

- The market size in 2022 is about 1.4 billion US dollars, accounting for 30% of the global market

- The compound annual growth rate is expected to be 26% from 2023 to 2028, the highest in the world

- The Chinese market is growing the fastest, with an annual growth rate of nearly 30%

- Market drivers:

- Large-scale investment in AI computing infrastructure

- Government strategic support for AI technology

- High-density urban environments drive the demand for space efficiency

- Regional characteristics:

- Emphasis on cost-effectiveness and large-scale production

- Rapid development of local manufacturing capabilities

- Balance between innovation and practicality

Regional market comparison

| Region | Market size (2022) | Annual growth rate (forecast) | Liquid cooling penetration | Main growth drivers |

|---|---|---|---|---|

| North America | $1.8 billion | 21% | 40% | Hyperscale AI investment, performance requirements |

| Europe | $1.2 billion | 24% | 45% | Energy efficiency regulations, sustainability |

| Asia Pacific | $1.4 billion | 26% | 35% | Infrastructure expansion, government support |

| Other regions | $300 million | 20% | 25% | Data center modernization, cost optimization |

Emerging Market Opportunities

In addition to the major regions, some emerging markets also show significant potential:

- Middle East and Africa:

- Large-scale data center investments in Saudi Arabia and the UAE

- Extreme climate conditions drive innovative cooling solutions

- Expected CAGR of 19% from 2023 to 2028

- Latin America:

- Rapid data center capacity growth in Brazil and Mexico

- Strong demand for cost-effective solutions

- Expected CAGR of 18% from 2023 to 2028

- Southeast Asia:

- Singapore’s position as a regional data center hub

- Rapid growth in Indonesia and Vietnam

- Unique cooling challenges caused by high temperature and high humidity environments

Here is a key point: emerging markets can often skip certain technology development stages and directly adopt state-of-the-art solutions. For example, some new Asian and Middle Eastern data centers use liquid cooling technology from the beginning, rather than using traditional air cooling systems and then upgrading. This “leapfrogging” development creates unique market opportunities for innovative technology providers.

4. Investment Opportunities and Risk Assessment

The rapid growth of the AI server radiator market has created abundant investment opportunities, but also comes with significant risks. Understanding these opportunities and risks is critical for investors and corporate decision makers.

Problem: Although the market is growing rapidly, the technology path and winners have not yet been fully determined, increasing the complexity of investment decisions.

In this rapidly developing market, investors face the challenge of choosing among multiple potential technology paths and business models. Choosing the wrong technology or entering at the wrong time may lead to investment failure.

Aggravation: The market consolidation trend is obvious, and the entry of large enterprises may squeeze the living space of startups.

More worryingly, as the market matures, technology standardization and commoditization may occur, which may reduce profit margins and change the competitive landscape. At the same time, the vertical integration strategy of hyperscale cloud providers may further change market dynamics.

Solution: Use a structured investment analysis framework to evaluate the opportunities and risks of different market segments and technology paths:

High-potential investment areas

Several market segments show particularly strong growth potential and investment attractiveness:

- Direct liquid cooling technology:

- Market growth: 30-35% CAGR

- Investment attractiveness: technology is relatively mature and market acceptance is increasing

- Target companies: companies focusing on cold plate design, cooling distribution units and system integration

- Expected payback period: 3-5 years

- Immersion cooling solutions:

- Market growth: 40-45% CAGR, but small base

- Investment attractiveness: high disruptive potential, but also high technical and market risks

- Target companies: innovative coolant developers, modular system design companies

- Expected payback period: 5-7 years

- Intelligent cooling management system:

- Market growth: 25-30% CAGR

- Investment attractiveness: high software profit margin and good scalability

- Target companies: AI-driven predictive cooling software, digital twin technology

Expected Return Period: 2-4 Years

Here’s where things get interesting: Not only are these market segments growing rapidly, they are also at different stages of technology and market maturity, providing investors with a diverse risk-reward profile. For example, direct liquid cooling technology is relatively mature, offering more predictable but potentially lower returns, while immersion cooling is still in its early stages, offering higher potential returns but also greater risk.

Investment Opportunity Comparison

| Market Segment | Market Growth Rate | Technology Maturity | Competitive Intensity | Entry Barrier | Investment Attractiveness |

|---|---|---|---|---|---|

| Direct Liquid Cooling Technology | High | Medium-High | Medium | Medium | High |

| Immersion Cooling | Very High | Medium | Low-Medium | High | High (High Risk and High Return) |

| Intelligent Cooling Management | High | Medium | Low-Medium | Medium-High | High |

| Traditional Air Cooling Upgrade | Medium | High | High | Low | Low-Medium |

| Heat Recovery System | Medium-High | Medium | Low | Medium | Medium-High |

Investment Risk Assessment

Investing in the AI Server Radiator Market requires considering a variety of risk factors:

- Technology Risk:

- Uncertainty in technology paths: Multiple cooling technologies are developing in parallel, and the ultimate dominant technology has not yet been determined

- Speed of innovation: Rapid innovation may lead to rapid technological obsolescence

- Intellectual property challenges: Patent-intensive fields may face infringement risks

- Market risks:

- Uncertainty in adoption rates: Market acceptance of new technologies may be lower than expected

- Price pressure: Commoditization and price competition may occur as the market matures

- Customer concentration: A high concentration of hyperscale customers may lead to an imbalance in bargaining power

- Operational risks:

- Supply chain challenges: Supply constraints on key components and materials

- Talent shortage: Fierce competition for cooling professionals

- Scaled production: Transformation challenges from prototype to mass production

- Regulatory risks:

- Environmental regulations: Cooling fluids and materials may face stricter environmental regulations

- Energy efficiency standards: Increasing energy efficiency requirements may require continued R&D investment

- Data center restrictions: Restrictions on new data center construction in some regions may affect market growth

Want to know the best part? Despite these risks, the fundamental growth momentum of the AI server heat sink market is very strong as it directly benefits from the irreversible growth of AI computing demand. This creates a rare “must have” market opportunity – as AI continues to develop, advanced cooling solutions are not optional, but absolutely necessary.

5. Outlook for future market development trends

Looking ahead, the AI server heat sink market will continue to develop rapidly, but the development path and speed will be affected by multiple factors. Understanding these long-term trends is critical for strategic planning and investment decisions.

Problem: There are multiple possibilities for the long-term development trajectory of the market, depending on technological breakthroughs, AI development and the regulatory environment.

When formulating long-term strategies, simple linear forecasts can mislead decisions. The market may experience technological inflection points, regulatory changes, or shifts in AI application patterns, all of which may significantly change the growth trajectory.

Exacerbation: Market participants face the challenge of making long-term investment decisions in an uncertain environment.

Even more challenging is that the development of cooling technology is closely linked to the evolution of AI hardware architecture. If AI accelerator design undergoes fundamental changes (such as a shift to photonic computing or neuromorphic chips), it may completely change the cooling needs.

Solution: Use scenario planning to consider multiple possible future development paths:

Technology Evolution Path

The future development of cooling technology may evolve along multiple paths:

- Liquid Cooling Dominant Path:

- Direct liquid cooling technology becomes mainstream, occupying 70-80% of the market

- Immersion cooling gains a significant share in the high-end market

- Air cooling is mainly used for low-density applications and edge computing

- Hybrid Technology Path:

- Multiple cooling technologies coexist to adapt to different application scenarios

- Modular and interchangeable systems allow flexible configuration

- Intelligent management systems optimize the collaborative work of multiple cooling methods

- Disruptive Innovation Path:

- New cooling technologies (such as chip-level liquid cooling or supercritical CO₂) achieve breakthroughs

- New architectures such as 3D chip stacking drive fundamental changes in cooling methods

- Deep integration of computing and cooling, blurring traditional boundaries

Here is a key point: these paths are not mutually exclusive, but may develop in parallel in different time frames and market segments. For example, high-end AI training clusters may be the first to adopt disruptive technologies, while mainstream data centers follow a more incremental liquid cooling path.

Market consolidation and ecosystem evolution

In the next few years, the market structure may undergo significant changes:

- Consolidation trend:

- Large cooling solution providers expand technology portfolios through acquisitions

- System integrators vertically integrate key cooling technologies

- The entrepreneurial ecosystem continues to drive innovation, but the exit route is mainly acquisition

- Ecosystem development:

- Tighter hardware-cooling-facility integration

- Development of open standards to promote interoperability

- Deepening of specialization and division of labor

- Business model innovation:

- The rise of the “Cooling-as-a-Service” model

- Performance-based pricing replaces traditional hardware sales

- Heat recovery creates new revenue streams

Comparison of future market scenarios

| Scenario | Liquid cooling penetration rate (2028) | Market consolidation level | Innovation speed | Possibility |

|---|---|---|---|---|

| Liquid cooling dominates | 70-80% | High | Medium | High |

| Technology Diversification | 50-60% | Medium | High | Medium-High |

| Disruptive Innovation | 30-40%* | Low | Very High | Low-Medium |

Note: In the Disruptive Innovation scenario, the low percentage of traditional liquid cooling is due to the emergence of new cooling technologies

Long-term Market Drivers

Several key trends will shape the market development in the long term:

- Continued growth in AI computing demand:

- Large Language Models (LLMs) continue to scale

- AI applications shift from training to inference, but total computing demand is still growing rapidly

- Edge AI deployment creates new cooling challenges and opportunities

- Increasing pressure on sustainability:

- Carbon neutrality goals drive extremely energy-efficient cooling solutions

- Water resource constraints promote the development of closed-loop cooling systems

- Circular economy principles are applied to cooling system design and material selection

- Technology Convergence:

- Co-design of cooling and computing architecture

- Thermal considerations affect chip and system design decisions

Cooling technology innovation crosses materials science and microfluidics

Are you ready for the exciting part? In the long run, cooling may transform from the current “necessary cost” to a “strategic advantage”. Organizations that can master advanced cooling technology will be able to deploy denser and more efficient AI computing resources, creating a significant competitive advantage. This may lead to the transformation of cooling technology from a purely supporting function to a core strategic asset, further enhancing its market value and investment attractiveness.

Frequently Asked Questions

Q1: What are the main growth drivers of the AI server heat sink market?

The main growth drivers of the AI server heat sink market include: the explosive demand for computing resources for AI training and inference, which drives the large-scale deployment of high-performance GPUs and dedicated AI accelerators; the thermal design power consumption (TDP) of these AI hardware is much higher than traditional server components, and a single AI server may generate 6-8kW of heat, which is 3-4 times that of traditional servers; the increasing density of data centers, the increase in rack power from the traditional 5-10kW to the 30-50kW or even higher required by AI workloads; rising energy costs and stricter environmental regulations, driving more efficient cooling solutions; and accelerated technological innovation, especially in the field of liquid cooling and intelligent cooling management. Market research shows that the AI server heat sink market is expected to achieve a compound annual growth rate of 23.5% during 2023-2028, from approximately US$4.7 billion in 2022 to more than US$16.5 billion in 2028.

Q2: What is the position of liquid cooling technology in the AI server cooling market?

Liquid cooling technology is rapidly becoming a dominant force in the AI server cooling market, especially in high-density deployments. Liquid cooling solutions accounted for approximately 35% of the market in 2022 and are expected to grow to 55-60% by 2028. This rapid growth is driven primarily by three factors: First, the heat capacity of liquid is approximately 3500-4000 times that of air, enabling liquid cooling systems to more effectively handle the extremely high heat loads generated by AI hardware; second, liquid cooling technology can improve PUE from the traditional 1.5-1.8 to 1.1-1.3, significantly reducing energy costs; third, liquid cooling allows for higher density deployments, direct liquid cooling can support 30-60kW/rack, and immersion cooling can reach 100kW+/rack, far exceeding the capabilities of air-cooled systems. The main liquid cooling technologies include direct liquid cooling (cold plate), single-phase immersion cooling, and dual-phase immersion cooling, each with its specific application scenarios and advantages. It is worth noting that although liquid cooling is growing rapidly, the market is still in a stage where multiple technologies are developing in parallel, and different cooling solutions may be used in different application scenarios.

Q3: Who are the main players in the AI server radiator market?

Participants in the AI server heat sink market can be divided into four categories: traditional cooling solution suppliers, such as Vertiv, Schneider Electric, Asetek, and CoolIT Systems, who have rich industry experience and a broad customer base, but need to quickly adapt to new technologies; technology innovation startups, such as Submer, GRC (Green Revolution Cooling), Iceotope, and ZutaCore, who focus on disruptive technologies and flexible business models, but face challenges in scale and market trust; system integrators and OEMs, such as Dell Technologies, HPE, Lenovo, and Super Micro Computer, who provide end-to-end solutions and strong distribution channels; and hyperscale cloud service providers, such as Google, Microsoft, Amazon, and Meta, who are mainly purchasers but significantly influence market development through huge procurement scale and internal R&D capabilities. The market competition landscape is undergoing significant changes, with traditional suppliers facing challenges from innovative startups, while large technology companies are entering the field of cooling technology through acquisitions or independent R&D. Patent analysis shows that patent applications related to liquid cooling technology have increased by more than 300% in the past five years, indicating that the market is in the early acceleration stage of the technology S curve.

Q4: What are the characteristics of the AI server radiator market in different regions?

The global AI server radiator market shows significant regional differences: North America is the largest market, accounting for about 38% of the global market in 2022, and is expected to grow at a compound annual growth rate of 21% from 2023 to 2028, characterized by a high focus on innovation, performance optimization and total cost of ownership; the European market accounts for about 25% of the world, with an expected growth rate of 24%, characterized by strict energy efficiency standards, sustainable development requirements and widespread adoption of heat recovery systems; the Asia-Pacific region is the fastest growing market, accounting for about 30% of the world, with an expected growth rate of 26%, especially the Chinese market, which is growing by nearly 30%, characterized by large-scale infrastructure investment, government strategic support and emphasis on cost-effectiveness; emerging markets such as the Middle East, Latin America and Southeast Asia also show significant potential, and they are often able to skip certain stages of technology development and directly adopt the most advanced solutions. These regional differences are affected by local data center development, AI adoption rates, energy costs, climate conditions and regulatory environments, requiring companies to develop differentiated regional strategies rather than simply copying the successful model of one region to another.

Q5: What are the long-term development trends of the AI server radiator market?

The long-term development trends of the AI server heat sink market include: technology evolution may develop along multiple paths, including liquid cooling-dominated paths, hybrid technology paths, or disruptive innovation paths, such as chip-level liquid cooling or supercritical CO₂ cooling; the market consolidation trend is obvious, large cooling solution providers expand their technology portfolios through acquisitions, while the entrepreneurial ecosystem continues to drive innovation; business model innovation, such as the rise of the “cooling as a service” model and performance-based pricing replacing traditional hardware sales; AI computing needs continue to grow, large language models expand in size, AI applications shift from training to reasoning, and edge AI deployment creates new cooling challenges; increasing pressure on sustainable development drives extremely energy-efficient cooling solutions and closed-loop systems; technology convergence, co-design of cooling and computing architecture, and cooling considerations affect chip and system design decisions. In the long run, cooling may change from the current “necessary cost” to a “strategic advantage”, and those organizations that master advanced cooling technology will be able to deploy denser and more efficient AI computing resources, creating significant competitive advantages.